If totals are not equal, it means that an error was made in the recording and/or posting process and should be investigated. In other words, a trial balance shows a summary of how much Cash, Accounts Receivable, Supplies, and all other accounts the company has after the posting process. You can now compare your 1st column with the last period’s closing balances or the 1st day of this period’s balances to ensure accuracy. In other words, a trial balance will show all of the balances of accounts after all transactions have been allowed for, including those which have not yet been entered into a general ledger or subsidiary ledgers.

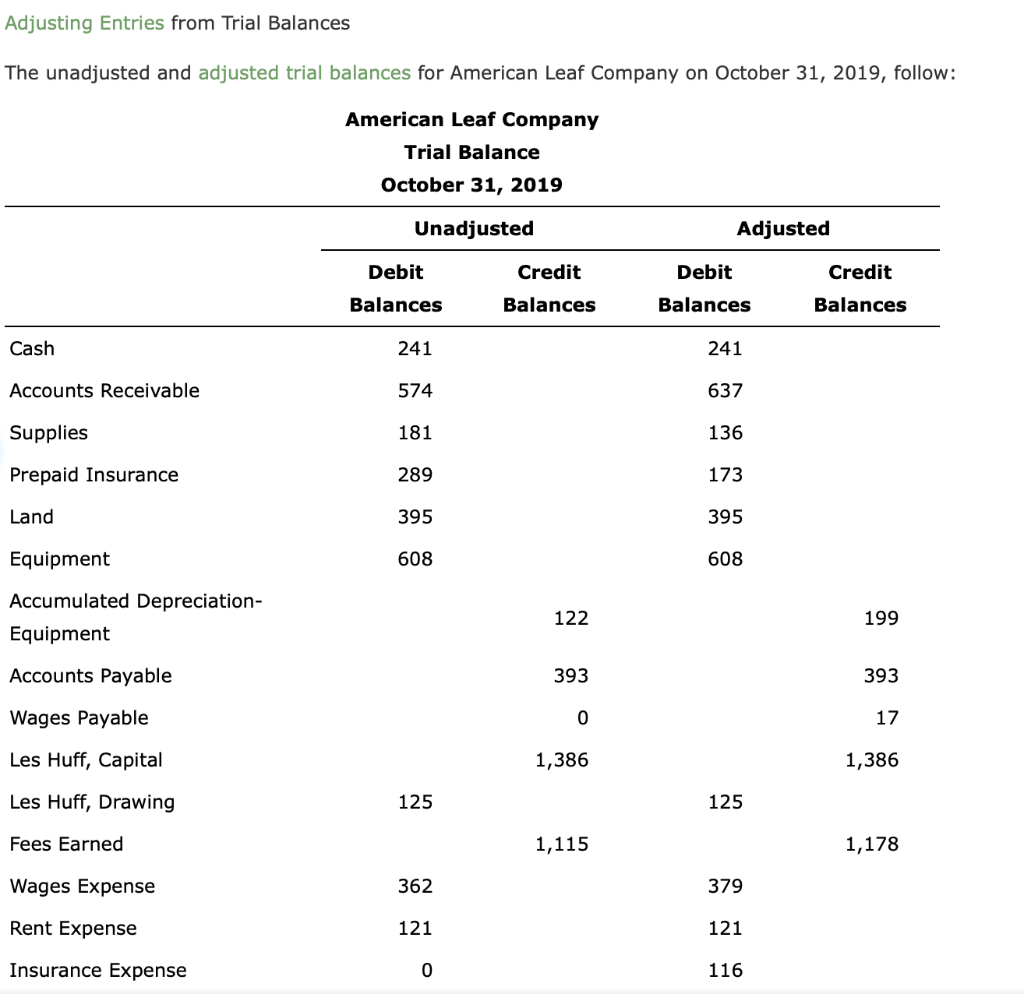

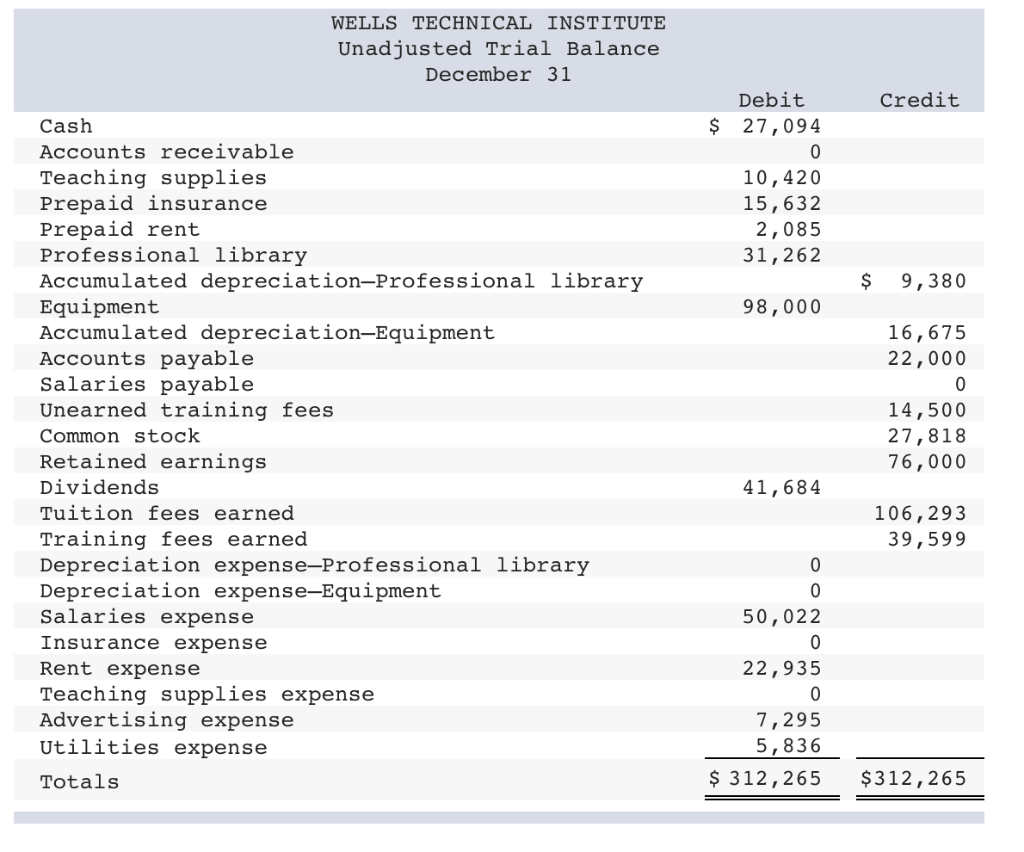

- However, before every transaction is presented in an organized manner, there is a rough list of transactions accommodated in the unadjusted trial balance.

- As the bookkeepers and accountants examine the report and find errors in the accounts, they record adjusting journal entries to correct them.

- Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year.

- Unadjusted trial balance is used to identify the necessary adjusting entries to be made at the end of the year.² Adjusting entries are made mainly due to the usage of accrual system of accounting.

Equal Doesn't Always Mean Correct

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Tax accountants and auditors also use this report to prepare tax returns and begin the audit process. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. After that, Adjusting Entries will be passed in the relevant accounts to prepare Adjusted Trial Balance, which is the last step before Financial Statements are produced. Income Summary is then closed to the capital account as shown in the third closing entry.

Three Types of Trial Balance

The post-closing trial balance contains real accounts only since all nominal accounts have already been closed at this stage. Unadjusted trial balance – This is prepared square and xero after journalizing transactions and posting them to the ledger. Its purpose is to test the equality between debits and credits after the recording phase.

Why is it important to prepare the unadjusted and adjusted trial balance?

We follow ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Much of our research comes from leading organizations in the climate space, such as Project Drawdown and the International Energy Agency (IEA). Carbon Collective is the first online investment advisor 100% focused on solving climate change. We believe that sustainable investing is not just an important climate solution, but a smart way to invest. Our team of reviewers are established professionals with years of experience in areas of personal finance and climate. Discover the best business bank accounts for sole proprietors in 2025, comparing top banks to help you find the perfect fit for your needs.

Get in Touch With a Financial Advisor

The unadjusted trial balance is the listing of general ledger account balances at the end of a reporting period, before any adjusting entries are made to the balances to create financial statements. The unadjusted trial balance is used as the starting point for analyzing account balances and making adjusting entries. The unadjusted trial balance is prepared by compiling a list of all the general ledger account balances as of a certain date. Once the list is compiled, the totals for debit columns and credit columns should be balanced. Preparing an unadjusted trial balance is the fourth step in the accounting cycle.

However, this is not an exhaustive list and there are a variety of other factors which could result in a mismatch. In case of errors, simply edit the 1st and 2nd columns of UBTB until you get the correct balances. Carbon Collective partners with financial and climate experts to ensure the accuracy of our content.

By providing a snapshot of all ledger accounts within a given accounting period, the trial balance helps business owners and accounting teams in reviewing accuracy. The biggest goal of a trial balance is to find accounting errors and transposition errors like switching digits. By highlighting these mistakes, the trial balance acts as an accuracy check for a business, mitigating the risk of inaccuracies before you generate final financial statements.

Unfortunately, you will have to go back through one step at a time until you find the error. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.